heloc draw period vs repayment period

Others could extend the repayment phase over decades. However the two most standard draw periods are 5 to 10 years.

Also during HELOC repayment lenders may allow their borrowers to draw.

. Use Our Comparison Site Find Out Which Lender Suits You The Best. Quick Simple Way To Unlock Your Equity. You are now required to begin paying back the principal balance in addition to paying interest.

However the payment mechanics still seem ambiguous. Another benefit of a PNC HELOC is that the repayment period is 30 years. This period typically lasts five to 10 years.

During this time we advise that you meet with one of our HELOC Specialists at 855-726-1477 and explore the options you have once your draw period has ended or is ending. Typically a HELOCs draw period is between five and 10 years. Once the repayment period begins the line of credit cant be.

Some lenders will offer longer draw periods if. Heres an example to get a better understanding of the process. When the draw period ends the HELOC enters repayment.

Compare Top Home Equity Loans and Save. Get The Cash You Need To Pay For Whats Important. The draw period during which you can withdraw funds might last 10 years and the repayment period might last another 20 years making the HELOC a 30-year loan.

During the draw period you are allowed to access your line of credit and borrow as much or as little as you need. 2 days agoAt todays rate a 25000 10-year HELOC would cost a borrower approximately 114 per month during the 10-year draw period. A HELOC has 2 different phases a draw period and a repayment period.

Refinance Before Rates Go Up Again. Fast Easy Process. Ad Apply Online For A HELOC Loan Today.

You can even switch between variable and fixed-rate interest over the course of your draw period. Once the draw period is up youll enter the repayment period where youll repay the remaining balance in installments over a fixed number of years. Ad Trusted Reviews Trusted by 45000000.

Once the heloc draw period is over the. The HELOC end of draw period is when you enter the repayment phase of your line of credit. When you need to cover a big expense such as home remodeling a childs wedding or an unexpected hospital bill a home equity line of credit is one option for getting.

The good news is that during this time you just have interest-only payments to make on the money youre borrowing. Ad Todays 10 Best HELOC Loan Rates. Ad Compare the Best HELOC Loan Offer Get Pre-Approved By Top Lenders.

O The draw period is the initial 10 years of the loan when you. The draw period for HELOCs will vary based on your lender and your needs. Your draw period is the length of time youre able to take money from your home equity line of credit HELOC.

Ad Home Improvements College Tuition Or Debt Consolidation - A Cash-Out Refinance Can Help. Ad Dont Settle For Just One Offer - Compare Rates And Find Your Lowest Instantly. Be aware that a HELOC generally operates on a variable APR which can mean that your.

While HELOC terms can vary based on the bank issuing the line of credit they all follow this basic structure. It will last for several years typically 10 years max. Use LendingTrees Marketplace To Find The Best Option For You.

Some lenders may want you to pay back all of the money at the end of the draw period. Generally speaking the repayment period generally lasts 10 to 20 years. Ad Put Your Home Equity To Work Pay For Big Expenses.

Ad Give us a call to find out more. 19 When you pay down your credit. Compare Rates Apply Online Today.

You have a draw period followed by a repayment period. It Costs 0 to Run the Numbers Recalculate Your New PaymentDont Wait Refinance Save. During the repayment period which is often 20 years in length you will typically make.

Ad Give us a call to find out more. Skip The Bank Save. Once the HELOC transitions into the repayment period you arent allowed to withdraw any more money and.

Based on my research theres typically a draw down period. Apply Get Fast Pre Approval. Once HELOC draw periods expire borrowers start paying down the money they drew.

Special Offers Just a Click Away. You can think of your home equity line. Its a fairly flexible low cost way of tapping into equity on a home.

After the draw period there is a repayment. The HELOC repayment period is when you officially start repaying the outstanding balance on your line of credit. If your lender offers you a 30-year HELOC with a 10-year draw period how it works is youll pay interest only on the.

Essential Differences Between Home Equity Loans And Helocs Cccu

What Is A Home Equity Line Of Credit Heloc And How Does It Work

Using A Home Equity Loan Or Heloc To Pay Off Your Mortgage Credible

Here S What You Need To Get A Home Equity Loan Or Heloc

Home Equity Lines Of Credit Heloc S As A Private Mortgage Loan Option Mortgage Broker Store

/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

How A Heloc Works Tap Your Home Equity For Cash

:max_bytes(150000):strip_icc()/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

How A Heloc Works Tap Your Home Equity For Cash

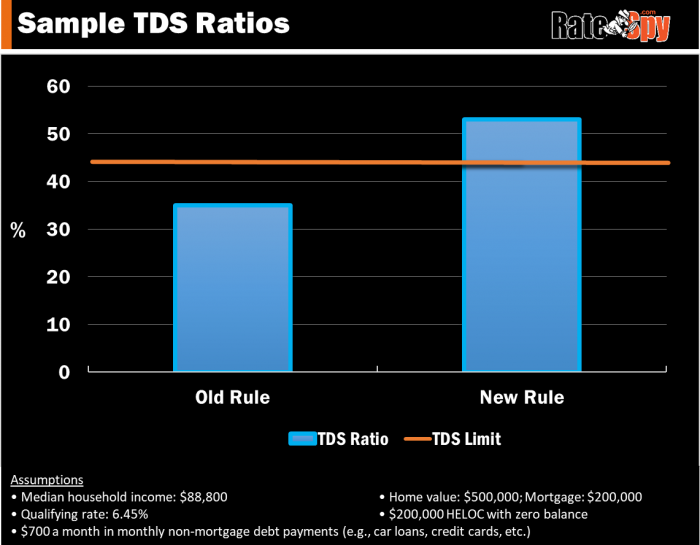

Got A Heloc Your Mortgage Options Are About To Shrink Ratespy Com

What To Know Before Your Heloc Draw Period Ends Nextadvisor With Time

Using Heloc Funds For Home Renovations Liberty Bay Credit Union

More Home Loan Options To Increase Your Buying Power Heloc Homeloans Mortgages Crestico Mortgagesmadeeasy Lowinterestrates Home Loans Heloc Loan

What Is A Heloc And How Does It Work

What You Should Know About Home Equity Lines Of Credit Heloc Canandaigua National Bank Trust

:max_bytes(150000):strip_icc()/dotdash-INV-infographic-Home-Equity-Loan-v1-9ae3dc9a5cc141d5a25ed2975c08ea1c.jpg)